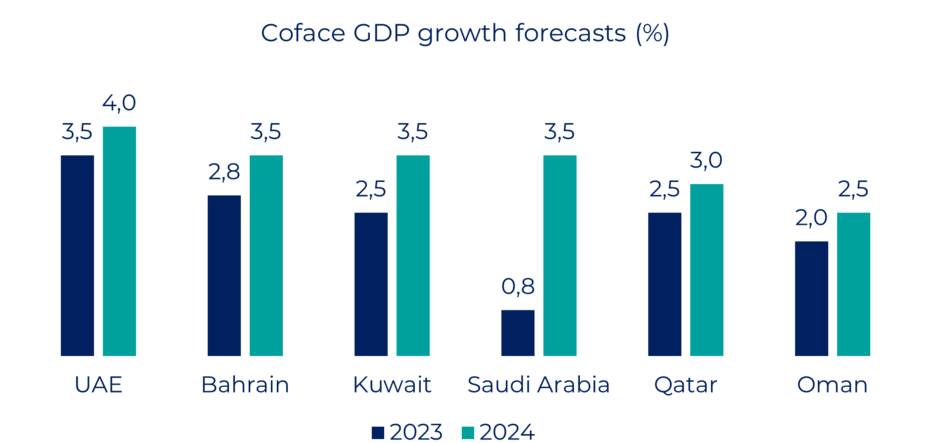

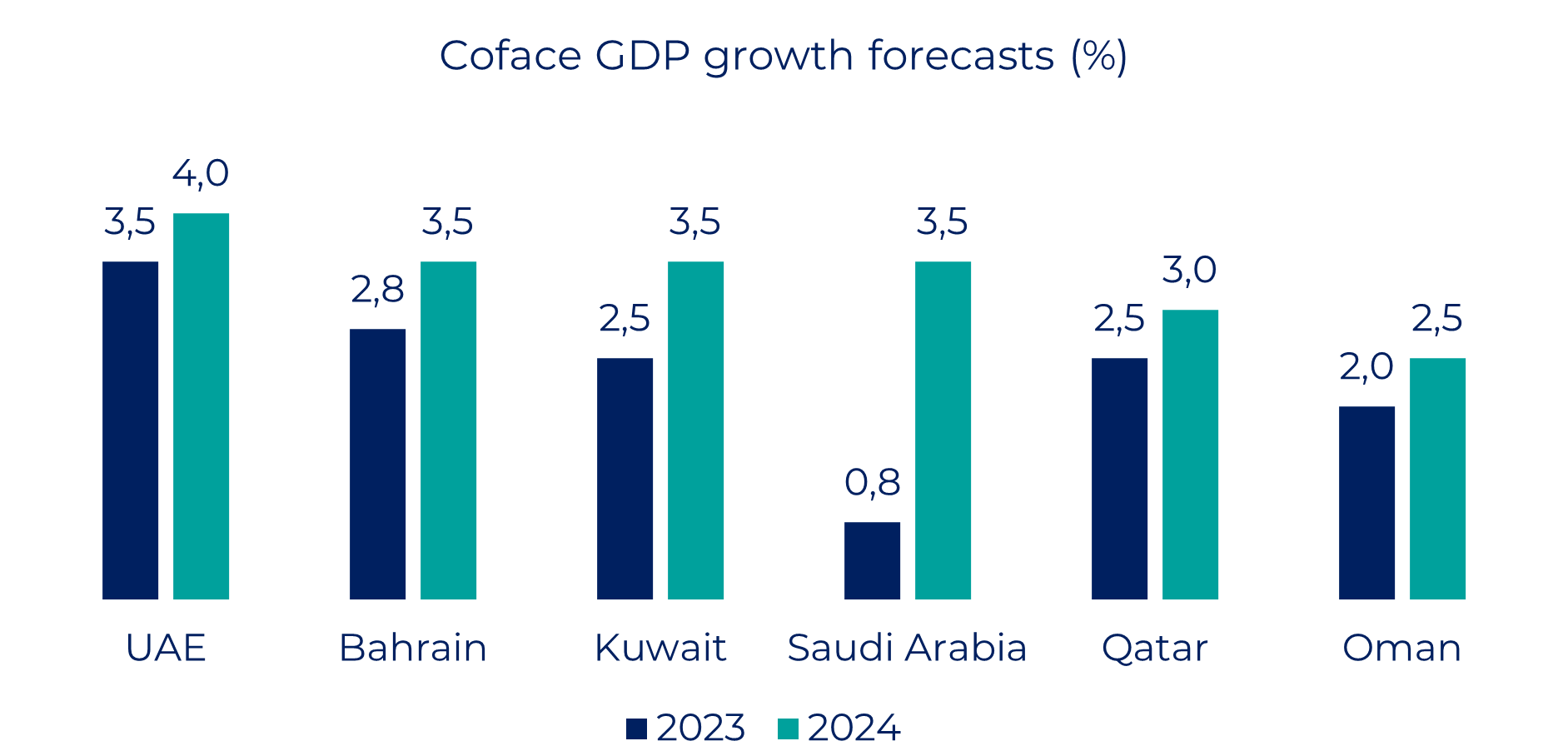

Nakon usporavanja u 2023. uglavnom zbog nižih cena proizvodnje i energije, očekuje se da će 2024. biti godina većeg ekonomskog rasta za zemlje Saveta za saradnju u Zalivu (GCC), pošto su, posle nekoliko meseci pesimizma u pogledu globalne potražnje za naftom, cene rasle od leto. Ali nisu sve zemlje jednake...

Povoljno ekonomsko okruženje ne sme da prikrije strukturne slabosti nekih ekonomija: Bahrejn i Oman, najslabije tačke u pogledu javnih računa

Posle višemesečnog pesimizma oko svetske tražnje za naftom, cene su počele da rastu nakon što je Rusija, a pre svega Saudijska Arabija, najavila produžavanje smanjenja proizvodnje do kraja godine. Međutim, ovo blago povećanje cena nafte neće podjednako koristiti svim ovim zemljama.

Zbog visokog nivoa javnog duga, strukturnih fiskalnih slabosti i ograničenih prirodnih resursa u poređenju sa drugim zemljama u regionu, Bahrein i Oman moraju ostati na oprezu. Bahrein će nastaviti da beleži najveći odnos javnog duga prema BDP-u u regionu od 125% u 2023. S obzirom na visok nivo cena nafte koja pokriva fiskalni bilans, procenjen na oko 125 USD po barelu u 2023. godini, vlasti su počele da razmatraju mere koje bi ograničile dalje povećanje budžetskog deficita. Uprkos upornim viškovima na tekućem računu, veliki fiskalni deficit i potreba da se održe valutna veza opterećuju devizne rezerve Bahreina. Dok se rezerve koje pokrivaju tromesečni uvoz konvencionalno smatraju minimalnim adekvatnim nivoom, rezerve Bahreina bi pokrivale samo 1,5 meseci uvoza 2023. godine.

Dinamika duga Omana izgleda uravnoteženija, ali takođe pati od strukturnih fiskalnih slabosti, uglavnom zbog ograničenih prirodnih resursa. Od pada cena nafte 2015. i 2016. godine, Oman kontinuirano beleži dvostruki deficit (kako na tekućem tako i na fiskalnom računu).

U pomoć obično priskaču Saudijska Arabija i Uae, mnogo manje ranjivi

Saudijska Arabija, Kuvajt i Ujedinjeni Arapski Emirati obično priskaču u pomoć u hitnim slučajevima kada nedostaju sredstva.

Ove 3 zemlje najavile su paket pomoći Bahreinu od 10 milijardi dolara 2018. godine, nakon što su 2011. dale 20 milijardi dolara i Omanu i Bahreinu što je osnova strateških i ekonomskih saveza između ovih zemalja. Ova sredstva su uglavnom podržala smanjenje fiskalnih deficita u Omanu i Bahreinu i ublažila negativne efekte programa fiskalne konsolidacije. Drugi cilj ove fiskalne saradnje je usklađivanje svih ekonomija GCC-a oko sličnih regionalnih inicijativa kroz uvođenje određenih fiskalnih reformi.

Različite finansijske situacije, ali(skoro) ista monetarna politika

Ove različite strukture u ekonomijama GCC-a pokazuju da je njihova finansijska situacija nejednaka, iako su ove zemlje formirale ekonomski i finansijski savez. Međutim, što se tiče monetarnih pitanja, oni imaju vrlo slične strukture: njihove valute su vezane za američki dolar, osim za Kuvajt, koji ima valutu vezanu za nepoznatu korpu valuta. U skladu sa budućim političkim potezima Fed-a, očekujemo da centralne banke GCC-a drže kamatne stope na čekanju dok Fed ne odluči da započne ciklus smanjenja stopa.

Čvrsta konkurencija u sektorima ciljanim nastojima diverzifikacije

Iako i dalje u velikoj meri zavise od naftnog sektora, zemlje GCC-a su sprovele planove ekonomske diversifikacije nakon pada cena nafte između 2014. i 2016. Dok su UAE prednjačili u ekonomskoj diversifikaciji, Saudijska Arabija je najavila značajna ulaganja poslednjih godina. Budući da ove dve zemlje, kao i Katar i, u manjoj meri, Oman, ciljaju skoro iste sektore (građevinarstvo, turizam, finansije), ključni rizik leži u stvaranju konkurencije u regionu. Pored toga, glavni izvori finansiranja ovih strategija diverzifikacije zasnivaju se na prihodima od nafte. Uzimajući u obzir ova dva faktora, strategije ekonomske diversifikacije, iako su izvodljive, možda neće dati željene rezultate.