How Coface uses advanced Data Science to help businesses

Artificial intelligence, massive data analysis, Machine Learning, predictive analytics and modeling, Deep Learning and Image Processing…

Coface uses a whole set of advanced Data Science technologies to design new solutions for its clients.

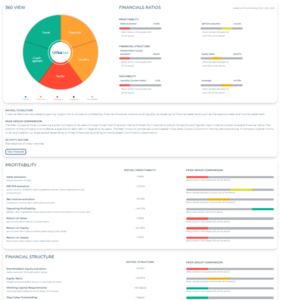

BUSINESS INFORMATION: comparing a company's financial ratios to its peers’ to help steer its commercial strategy in a few clicks

Is a company is more or less profitable than its main competitors? How does its debt ratio compare to similar industry players? How robust is its financial structure? Coface’s Data Lab has created Peer Groups to meet the needs of clients keen to exploit financial information to assess their customer and supplier chain. The solution is designed to evaluate a company in relation to its peers based on a wide range of financial analysis criteria compared in real time.

This comparative database is built on extracting and processing over 5 million financial reports of companies from all geographies and sectors where Coface operates. It can be used to draw up a ranking derived from a series of criteria: including profitability, solvency, industry, geographical location, size segment…

This financial ratio ranking (up to 24 ratios) is then translated visually and dynamically in URBA360, Coface's new information platform. Companies nowadays need to do more than simply access large data sources to steer their development strategy - which is why our clients can use Peer Groups to benefit from new qualified data and information on relevant insights that is easy to exploit.

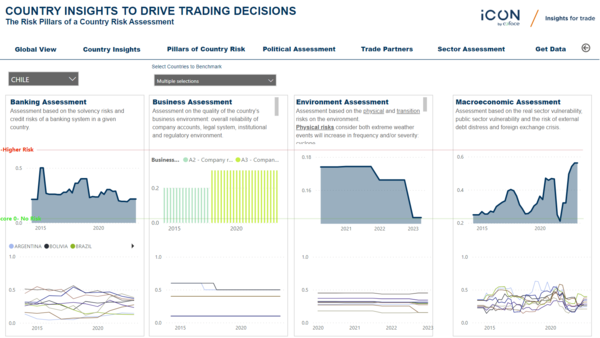

ECONOMIC INSIGHTS: a dynamic analytic dashboard and unique information for anticipating risk and looking for investment opportunities

Coface's client companies are frequently looking for data and analysis on global economic trends to take informed decisions regarding their development strategy and management of client and supplier risks. Coface has addressed this need by producing Economic Insights, providing its clients with all its economic intelligence and assessments.

Based on Coface's Economic Intelligence and Business Information Services, this solution can be harnessed to assess risk in over 160 countries and 13 sectors. These dynamic dashboards draw on extensive analysis of the data and metrics produced by Coface’s economists worldwide.

Thanks to Economic Insights, Coface’s clients can:

- Analyse the economies of various countries to guide their investments.

- Undertake cross-analyses by country and sector more quickly and compare different suppliers to help them take strategic decisions about managing supply chains.

- Assess political risk or macro-economic conditions that may affect a company's profitability and whether a business decision is the right one.

- Measure business risks for their development in specific regions or economic sectors.

- Embed Coface's scores and assessments in their own decision-making engines: the business environment, macro-economic risk, banking risk, environmental risk, political and social risk, fragility index, conflict index, buyer risk assessment, payment index, and so forth.

- Save valuable time with quarterly updates and data histories over more than 10 years.

INDEMNIFICATION & DEBT COLLECTION: upgrading claims management using Deep Learning & Image Processing technologies

Coface is rolling out new solutions designed to optimise claims management in order to deliver an optimal quality of service to its clients by streamlining the work of indemnification and debt collection managers. The Coface Data Lab has developed a solution based on OCR (Optical Character Recognition) technology and training advanced neural network algorithms. This new system is designed to tackle the substantial volume of unpaid declarations Coface’s clients make and the large number of documents to be collected and checked "manually" by the management teams.

For each new declaration of unpaid debts requiring indemnification, the tool analyses all the documents provided by clients, detects and distinguishes invoices from other types of document. It then identifies the key information (invoice number and date, the payment due date, the total amount and VAT, etc.) from among all the digital and textual content extracted by the OCR. To identify and automate the extraction of this key data, Coface must train artificial intelligence algorithms on hundreds of thousands of documents from records processed previously by the manager teams.

And the result? In a few minutes, the software can detect files where the notification for which the declaration of unpaid invoices is incomplete. By reducing manual analysis work by 70%, this solution improves the deadlines for processing claims and speeds up the indemnification process for the benefit of Coface’s clients. This is all the more important since the indemnification and debt collection phase is a crucial time for a client that could be affected because one of its orders hasn’t been paid !

>> Let one of our expert call you back or get more information on our data solutions on our business information platform iCON by Coface.