Agri - food sector in Serbia

Taking into account that the business climate is stable for the last 2 quarters (grade A4 given by Coface Country risk assessment) and that the agri-food sector is characterized in Central Eastern Europe as a medium risk sector considering several factors, it is of particular importance to look at Agri - food sector in Serbia.

Relatively resilience to the consequences of the COVID-19 health crisis, as food needs are not very compressible, is percieved as the main advantage of doing business in agri-food sector. But on the other hand there are also disadvantages such as:

- Vulnerability to energy and input (consequences of war in Ukraine) which was also what the companies from this sector put the most emphasis on while we gathered insights from the market for the purposes of our analyzes

- Volatility of agricultural commodity prices

- Sector heavily exposed to climatic and biological hazards, aggravated by the increased frequency of extreme events (heat waves, floods, fires, etc.)

Statista shows to us that the food market in Serbia is expected to grow annually by 6.13%. In Serbia, the market's largest segment is Meat with a market volume of US$2.15bn in 2023. (source: Statista)

While assessing companies in Coface, we are trying to understand the whole picture on current situation of certain business entities and main factors which had dominantly affected business performance. Not counting only on financial figures but getting insights regarding reasons that stay beyond certain company’s performance.

The impact of inflation is one of the biggest problems highlighted by companies in analyzes conducted by Coface as well as impact of the war in Ukraine which caused an increase in energy prices, which was reflected in a significant increase in operating costs. Looking at the situation related to the RussianUkrainian conflict, the supply routes in Serbia suffered less damage than the competition. This put pressure on companies trying to find a way to overcome difficulties arising from the increase of operating costs because of rising input prices. Some companies managed to maintain good financial indicators through an increase in sales volume.

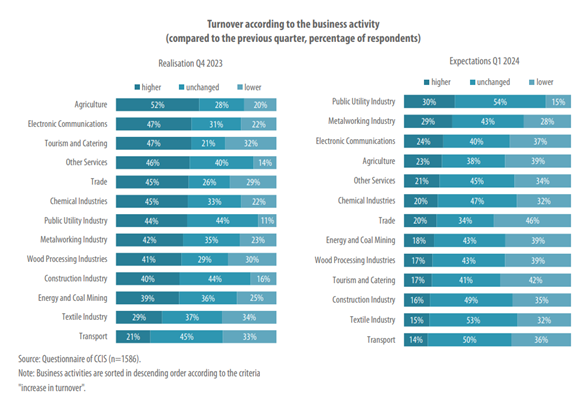

On the following graph we can see realization of turnover by economic branches (among other things for the agricultural sector) for Q4 2023 as well as what are the company's expectations for Q1 2024.

Source: Chamber of Commerce and Industry of Serbia, Business Activity of Companies in the Republic of Serbia.

According to the data of the Republic Institute of Statistics, by the end of October 2023, Serbia exported agricultural products worth 3.8 billion euros, while at the same time it imported food worth 2.7 billion euros.

In the first ten months of last year, Serbia achieved a surplus in the exchange of agricultural and food products of 1.1 billion euros.

Quantitatively speaking, 3.8 billion tons of goods were exported, and 1.4 billion tons of different goods from the category of agricultural and food products were imported. Looking at categories, Serbia imported over 3,600 tons of live animals in the mentioned period, and exported 15,000 tons. On the other hand, as many as 68,000 tons of meat and meat products were imported, while 23,000 tons were exported from Serbia to the global market. When it comes to cereals and cereal products, exports were 1.5 million tons, while imports amounted to only 104,000 tons.

Serbia mainly imports fruits and vegetables

From agricultural products, Serbia imports the most fruits and vegetables, 467,000 tons, followed by beverages, 155,000 tons, and animal feed - 111,000 tons. If we look at the value of exported agricultural production, the most important products are vegetables and fruits, whose export value was over 870 million euros, followed by cereals with 562 million euros, tobacco and tobacco products 450 million euros, beverages 395 million euros, animal feed - 322 million EUR, and the smallest was the export of animal products, oils and fats, EUR 4.12 million.

Also, the highest value of imported goods was on the side of vegetables and fruits over 526 million euros, followed by coffee, tea, cocoa, followed by spices and spice products, which were imported for 305 million euros, and then there are various food products and processed products with imports of 253 million euros.

[source: Statistical office of the Republic of Serbia].

In accordance with data that we in Coface are producing for assessing Serbian agro market, we can point out that there are signs of stabilization at the market which are still needed to be monitored in the upcoming period. Fluctuations in the prices of inputs are noticeable - as these prices of raw materials rose significantly after the COVID-19 pandemic and didn't return to the level they were in the period before pandemic. After pandemic, additional difficulties for companies arose during the conflict in Ukraine. We noticed that companies are more than before cautious when it comes to setting long-term plans regarding the business which is the result of an unpredictable, but also to some extent tense situation on the market.

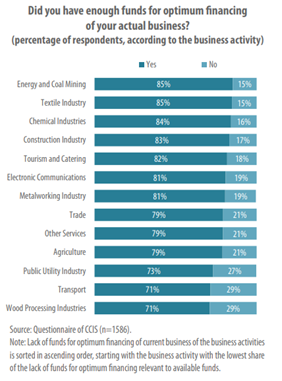

Companies from the field of agriculture expressed their opinion on whether they had sufficient funds for optimal financing of current operations in 2023 and we can see their answers on the following graph:

However, what can be concluded is that the supply in the market has stabilized, and companies, although more cautious when it comes to making long-term plans, have learned to manage faster and have become more agile, bearing in mind that they were forced to develop this possibility through the crises that started with the COVID-19 pandemic and continued with the Russian-Ukrainian conflict.

Source: Chamber of Commerce and Industry of Serbia, Business Activity of Companies in the Republic of Serbia

COFACE : FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface’s experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface’s insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2022, Coface employed ~4,720 people and registered a turnover of €1.81 billion