Strengths

- Speciality chemical companies are benefiting from innovative products aimed at tackling environmental risks

- Speciality chemicals companies are less vulnerable to changes in the economic cycle

Weaknesses

- Petrochemicals highly dependent on changes in the economic cycle

- Stricter regulatory environment forcing producers to overhaul their business models

- Significant legal risks resulting from the effects of some chemicals on human health

- High raw input prices making operations difficult and denting margins

Risk Analysis

Risk Analysis Synthesis

Two segments are under our scrutiny when dealing with the chemicals sector: petrochemicals and speciality chemicals. Petrochemicals are more sensitive to changing economic conditions, while speciality chemicals appear to be much more resilient. Because of its pro-cyclical nature, the chemicals sector has benefitted from the global economic recovery, but activity has been impacted by production cuts induced by higher raw materials prices and increased energy bills in both China and Europe. As such, customer sectors will face difficulties in securing key materials during the first half of 2022, which may push petrochemical prices higher, as the mismatch between supply and demand intensifies competition for a secured access to sourcing. Furthermore, higher feedstock and energy prices could translate into higher output prices to preserve profit margins. Lastly, the path to carbon neutrality will influence companies in the global chemicals sector to reduce their environmental footprint in order to gain access to funds, as well as to avoid litigation risks that are growing due to increasing pressure from activists.

Notes for the reader

Net margin: ratio of profits to sales

Profitability: GOP on turnover

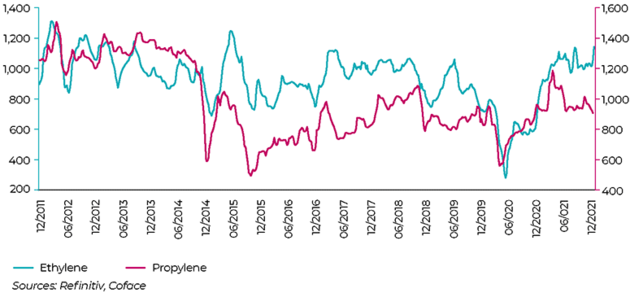

ETHYLENE AND PROPYLENE PRICES EVOLUTION

Sector Economic Insights

The sector recovered well after the easing of the pandemic-related restrictions in 2020. Prices of many chemical products experienced a rally as demand outpaced supply, and we expect this trend to persist in 2022 due to supply bottlenecks. For 2021 and 2022, Coface expects annual GDP growth rates of 8.1% and 6.1% in China, respectively. The United States and European Union economies should also recover from the 2020 contraction, with annual growth rates of 5.6% (2021) and 3.7% (2022) in the U.S., and 5.5% (2021) and 3.7% (2022) in Europe. As such, major petrochemical commodities and output prices have recorded increases on the back of strengthened demand and deteriorated sourcing availability. Efforts to refill feedstock inventories have been rendered difficult, notably after the Texas freeze caused outages during Q1 2021. These difficulties affected the major raw materials in the petrochemicals segment: naphtha and ethane prices soared, driving up petrochemical production costs. Coal is also witnessing a surge in its prices and should dent Chinese producers’ margins, especially those using the coal-to-ethanol route.

European average monthly ethylene prices increased threefold between the low of May 2020 and September 2021 (EUR 330/t to EUR 1013/t). Planned maintenances and outages removed large quantities of supply in Europe and the United States, which helped prices recover even though demand has not been growing steadily. Butadiene prices also strongly recovered after hitting lows in May 2020 in Europe and June in the United States, with the average price growing six-fold between Q3 2020 and Q3 2021. However, the persistent weakness felt in auto markets across the globe, notably due to chip shortages, continued to impact sales of raw materials for tyres.

Xylene solvent prices followed a similar upward path, as the average price increased by 171% between April 2020 and September 2021. This solvent is widely used during manufacturing processes, and the rising trend reflected the woes experienced by several industries such as fibre and leather processing, rubber, and metalworking. Purified terephthalic acid (PTA) is showing continuous signs of recovery due to the resumption of activity and sales in textiles. Polyvinyl chloride (PVC), a key material for the construction industry, witnessed a price rally due to demand outpacing a tight supply during 2020 and 2021. Outages induced by weather conditions in the United States helped prices to stay at high levels. In 2022, this trend is expected to continue, as power outages in China will lead to a reduction in supply because several provinces in the country are forcing PVC producers to cut output. However, demand in China is softening since the construction industry is impacted by the need to preserve air quality during the winter 2021-2022, and the will of the central government to cool high raw material prices to preserve margins of client sectors.

The petrochemicals industry also faces the same difficulties experienced by client sectors, such as automotive and other manufacturing activities, since chemicals are upstream of their production processes. These industries are coping with various challenges, including higher energy and feedstock costs, transport delays (notably in maritime freight), key component and material shortages (chips, lithium, magnesium, etc.), and a lack of labour (notably experienced workers). This particularly a concern in the automotive sector, with lower or stagnating vehicle sales in main markets induced by the inability of carmakers to source chips and semiconductors. Hurdles affecting supply will not abate smoothly during H1 2022, as many of the shortages are the direct consequence of years of underinvestment. Several major projects to build petrochemical plants are under construction with the objective to expand business in parts of the world where feedstock is plentiful or end-markets are growing, including the United States, the Arabian peninsula and Asia (China and India mainly). These new plants will boost production capacity and exert downward pressure on petrochemical prices, in addition to when demand softens and outages of key producers cease. The global trajectory of companies in the sector has been worrisome prior to the recovery amid decreasing margins and increasing net debt levels. Rising output prices failed to help the sector as input costs (energy and feedstock prices) were increasing as well.

Speciality chemical companies, while being impacted by the ongoing pandemic’s consequences on economic activity, have shown better resilience and lower price volatility than petrochemicals. They were also in a relatively more favourable position before the crisis. Entering this niche market requires continuous and costly R&D investment over several years. Another factor that protects speciality chemical companies from competition is the expertise developed over time in a business where the tastes of end consumers are constantly changing. They are also developing high-value products, such as particulate emission filters, which open up positive prospects in the context of the fight against environmental risks.

Differentiated recoveries across the world due to uneven impact of pandemic

China’s economic activity decelerated due to increasing infections, power outages and supply bottlenecks. Industrial production is slowing since July 2021. At end-September 2021, activity reached the level of April 2020 (103.1 vs 103.9), and 2022 could witness a low economic activity regime in China. In the Eurozone, the rebound in industrial production observed at the end of 2020 is showing some signs of fragility. For instance, car production in the Eurozone has been strongly hit by the current chip shortage. Moreover, higher energy prices (natural gas mainly) are translated into higher electricity bills. Some chemical companies in the fertiliser segment are reducing their activity on the European continent, being considered unprofitable. In the U.S., analyses of manufacturing production figures show a landscape similar to that of other large economies. American industrial production mostly recovered by Q1 2021, and marginally increased since then.

Sectoral reconfiguration will continue to be driven by regulation and evolution of consumers’ preferences

Like many sectors, the chemical industry faces stricter environmental regulations. The chemicals sector produces a lot of carbon emissions and toxic by-products, which makes it a target for activists to press for a reduction of its environmental footprint and impact on human health. These rules, which aim at limiting environmental risks resulting from chemical production processes, will increase production costs by adding multiple layers of complexity. Several areas are highlighted, from worker safety to the effects on the climate and natural resources. The governments of many advanced and emerging economies are paying close attention to environmental considerations amid growing public concern about climate change prevention and public health issues, which are spurring calls for changes to production models employed by companies in the sector. For instance, the NGO Greenpeace recorded that 34 out of 54 African nations have banned plastics since 2005. Many African governments are banning plastic bags, particularly those for single-use, the waste from which is plaguing the continent.

The rising demand from consumers and public opinion to limit plastic use for environmental reasons is also prompting shareholders to pressure management boards to respond to these changes in consumers’ preferences. There is growing citizen awareness globally about the importance of recycling amid heavy media coverage of the effects of micro-plastics ingestion on marine animals. The issue of recycling represents a risk for the sector, with Coface expecting a more widespread use of recycling practices to accentuate the decline in chemical production in several developed and emerging countries in the coming years.

The ongoing restructuring among actors in the sector is mainly due to the consequences of long-term price dynamics. According to Wood Mackenzie, 50 million tonnes per year of ethylene projects are underway globally. Some projects could be cancelled, but a large share are already under construction or in the engineering phase. Naphtha and ethane prices have also been highly volatile since 2018, notably because of the interruption caused by the pandemic, but also due to a lack of investment. The volatility of the abovementioned inputs (naphtha, ethane) led to a loss of competitiveness for companies in the sector, who also have to hedge themselves against it.

Last update : February 2022